Best Stock Funds to Make Money Investing in a Bad Stock Market

Anyone can make money investing in stocks or stock (equity) funds in a good stock market - but few make money investing in a bad market. If 2014 and/or 2015 turn ugly, there's a little "secret" about the best stock funds you should know if you are into stock investing.

I competed in the last CNBC international stock investing contest and beat 99.9% of the competition. This was in late 2011, and the field of competition included about half a million investment portfolios (trying to win the $1 million first prize). The market took a hit, and that's what I was betting on... so I loaded up on the best stock funds available at the time. Secret: You don't make money investing in equities (stocks) by trying to pick winners in a bad market. You make money by betting against the market. And that's what I did, taking advantage of all the financial leverage the contest would allow. Most investors do not know that you can bet on the downside.

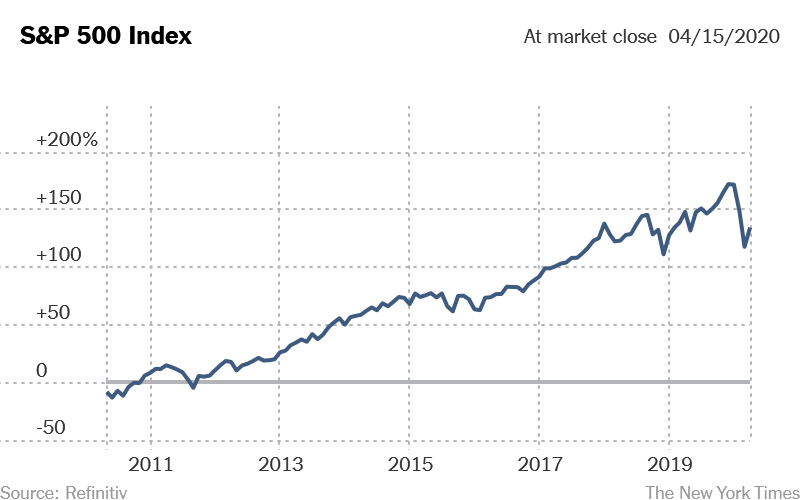

With the market UP about 150% since the lows of 2009, the years 2014 and 2015 could spell trouble for stock investing and investors who think they can pick winners. In a BEAR market the VAST MAJORITY of stocks fall and the biggest winners of yesterday become today's big losers. Period. The good news is that these days the process of betting against the market is simpler than ever. All you need is a brokerage account with a major discount broker. Then the best stock funds to make money investing in stocks in a bad market are available to you at a cost of about $10 a trade.

These best stock funds are called "inverse equity" funds. Simply stated, they are index funds called ETFs (exchange traded funds) and they trade just like any other shares do. To get your feet wet, I'll give you an example. The symbol SDS is a bet that the market (as measured by the S&P 500 Index, which represents the 500 biggest, best known corporations in America) will FALL in value. If the stock market (the S&P 500 INDEX) falls 1% in a day, SDS should go UP 2% (inverse leverage of 2 to 1). If the market in general falls 50% in 2014 and/or 2015, the price of SDS should go UP 100% (a double).

During the great DEPRESSION of the 1930s, some investors got rich as the market unraveled. In 2000-2002 and again in 2007-2009, the market tanked and some folks got rich by "short selling" or taking a "short position"... by betting against the market. Today, taking a short position is easier than ever before... and even the average investor can do it with inverse equity ETFs. You simply buy them and hope the stock market falls. Then, you try to time it so you sell them for a tidy profit if it does. In the old days the process of selling short was a bit more involved.

Most of the time stock investing is lucrative, but every few dow jones index years it gets ugly. You will never make money investing in stocks on a consistent basis. No one does, and not even the best stock funds in search of the best companies to own come close... because they are designed to bet on the upside. When the tide for equities goes out, at least 90% of stocks traded are losers. If you want to beat the stock market you've got to know when to hold them and know when to fold them. If you really want to make money investing in stocks you've also got to know when to short them.

These best stock funds for a bad market (inverse equity funds) are NOT for average investors who are investing money for retirement passively. These are only the best stock funds for those who want to play the stock market game actively (with simplicity) to do the best that they can. Stock investing is a big part of the game if you really want to put your money to work and make it grow. If you can make money investing in stocks in the bad years you'll be WAY AHEAD of the game. But it will require some time and attention on an ongoing basis.

© Copyright Tacticalinvestorweb